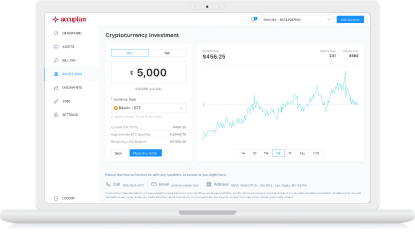

Crypto IRA: Retirement Meets Cryptocurrency

In the ever-evolving finance landscape, the emergence of cryptocurrencies has ushered in a new era of investment opportunities. One such avenue that has gained significant attention is the concept of a Crypto Individual Retirement Account (IRA). Investors can now use blockchain technology to secure their financial future and explore digital assets, combining standard investment strategies […]<p><a class="btn btn-secondary accuplan-read-more-link" href="https://www.accuplan.net/self-directed-ira/investments/bitcoin-ira/">Read More…</a></p>