Unlike a traditional individual retirement account (IRA), a self-directed IRA (SDIRA) allows you to invest in alternative assets like real estate. Investing in real estate can be a powerful move. However, it’s a less straightforward process to use an IRA to buy investment property, especially if your IRA is only funding a portion of the purchase. Learn partial IRA funding strategies for real estate, alternatives and how to comply with IRS regulations with expert support from Accuplan Benefits Services.

How to Use Part of Your IRA Funds for Real Estate Investments

What happens when your self-directed IRA is not purchasing an investment property all by itself? Maybe you are funding some of your investment with personal money, and the IRA will pay for the rest. Or maybe your IRA does not have enough money to make the purchase alone, so you need to secure outside funding from a lender. It’s possible to invest this way — you just have to know some basic math.

Let’s assume your IRA funds 20% of the total purchase of your investment property, then you secure a loan or have personal money for the remaining 80%. You will use this formula for everything pertaining to your investment.

- Repairs and maintenance: Your personal money will pay for 80%, and your IRA will pay for 20%.

- Property taxes: Your personal money will pay for 80% of the tax bill, and your IRA will pay for 20%.

- Rent: Your tenant will have to cut two checks. You receive 80%, and your IRA needs to receive 20%. Or, if you have a property manager, the tenant can send one check to the property management company, and the property management company can send two checks — one made payable to you and one made payable to your IRA. You should never split these check amounts on your own!

Other Alternatives to Splitting Every Transaction

You can avoid all this math with a self-directed IRA LLC account. This account has more paperwork, takes a little more time to set up and is more expensive. However, this is the best option when using only a portion of your SDIRA money to invest in real estate, or if you want to invest in multiunit or multifamily properties.

You create a special purpose limited liability company (LLC), which is either fully or partially owned by your SDIRA. This type of account will allow your IRA to fund a portion of the property’s purchase without worrying about keeping track of calculations due to the LLC that is attached. The LLC has a checking account so taxes, repairs and rent can come in and out of the checking account in full.

A lot of clients feel it’s worth paying for the convenience of an IRA LLC.

An IRA LLC is also a better fit for those who are looking to invest in a multifamily, multiunit or more than one single-family home. A self-directed IRA only has a certain number of free transactions per year. If the activity level is higher, you will start incurring additional fees. However, since an IRA LLC has an attached checking account, payments will go in and out of that account instead of going through your IRA custodian. Additionally, since the custodian isn’t involved, they won’t charge you fees. An IRA LLC can be a more cost-effective solution in the long run and more administratively friendly.

You can always change your SDIRA account into an IRA LLC account, but there’s usually a cost to convert. If you know your IRA is going to fund only a portion of your investment or you want to invest in more than one home or multiunit property, no need to add expense — just ask for an IRA LLC when you first open the account.

Understanding IRS Rules and Eligibility for Real Estate Investments

The main rule to understand is that your IRA owns the real estate, not you as an individual. Any money must go through the IRA, meaning the IRA must pay all expenses and receive all rental income. You personally cannot handle any income or expenses for the investment property. You also cannot perform any work on the property, such as maintenance, repairs or updates. Not following these rules risks your IRA losing its tax-advantaged status as a retirement account.

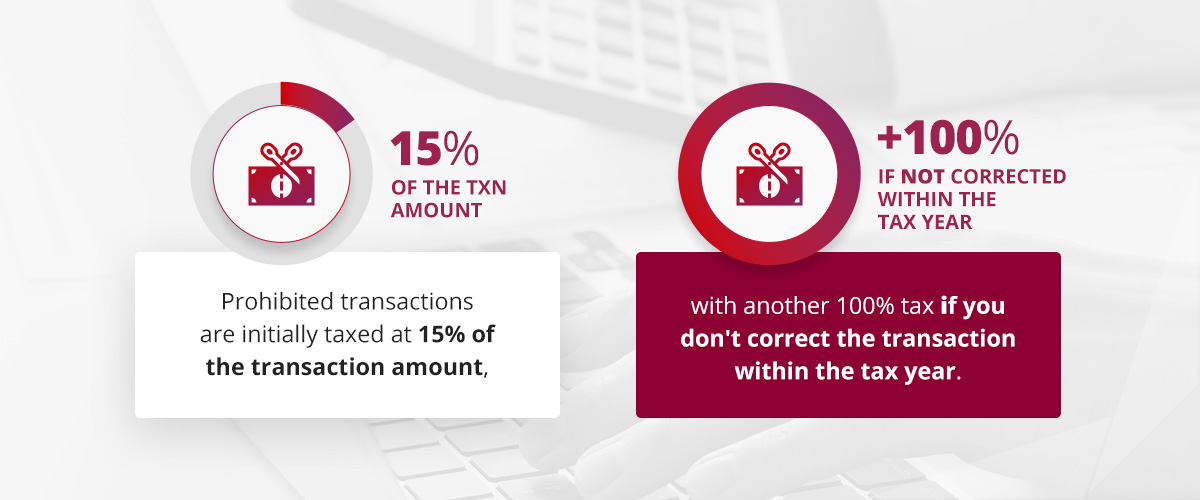

Additionally, self-dealing transactions are prohibited. Prohibited transactions are initially taxed at 15% of the transaction amount, with another 100% tax if you don’t correct the transaction within the tax year. Most prohibited transactions are those involving disqualified persons, which include:

- Your spouse

- Your parents and grandparents

- Your descendants and their spouses

- Anyone providing plan services

- Any entity, such as a business or trust, where you own 50% or more

You cannot borrow money from your IRA or use the account to secure a loan. Hiring a third-party property manager can help you avoid prohibited transactions and sweat equity violations.

Frequently Asked Questions

Here are the answers to some common questions about using an IRA to buy investment property:

- Can I buy property from my self-directed IRA? No, you cannot directly purchase property as an individual that your SDIRA currently owns, since you are a disqualified person. However, once you reach 59 ½ and are allowed to take distributions, you can transfer ownership of the property as an in-kind distribution. Similarly, you cannot sell property you own to your IRA.

- Can I use my IRA to buy a second house without penalty? No, real estate in your IRA must be for investment only. You cannot use it as a second home or a place for your parents or children to live. No one considered a disqualified person can benefit from the real estate.

- Can I use my IRA to buy land without penalty? As long as the transaction does not include disqualified persons, you can invest in land with your IRA.

- Can I get a loan to buy property in an SDIRA? Yes, you can, but it should be a nonrecourse loan. With this type of loan, the lender can only claim the property if you fail to repay the loan, not all the funds in the IRA. It’s important to know that loans can trigger unrelated business income taxes (UBIT) on profits from mortgaged properties.

- Can I use money from a Roth IRA to buy investment property? Yes, absolutely! The process is very similar whether your IRA is traditional or Roth. The main difference is that qualified distributions from a Roth IRA are tax-free, while qualified distributions from a traditional IRA are taxed as ordinary income.

Why Choose Accuplan Benefits Services for Your Self-Directed IRA

If you’re considering using your IRA money to buy investment property, Accuplan Benefits Services can help. Since 1985, our dedicated experts have helped clients plan for their future. We’re committed to client education so you can make informed decisions. We manage over $1.5 billion in assets and can support your SDIRA real estate investments, too.

To learn more, contact us to schedule a free consultation or chat online with one of our knowledgeable IRA specialists.

Our information shouldn’t be relied upon for investment advice but simply for information and educational purposes only. It is not intended to provide, nor should it be relied upon for accounting, legal, tax or investment advice.