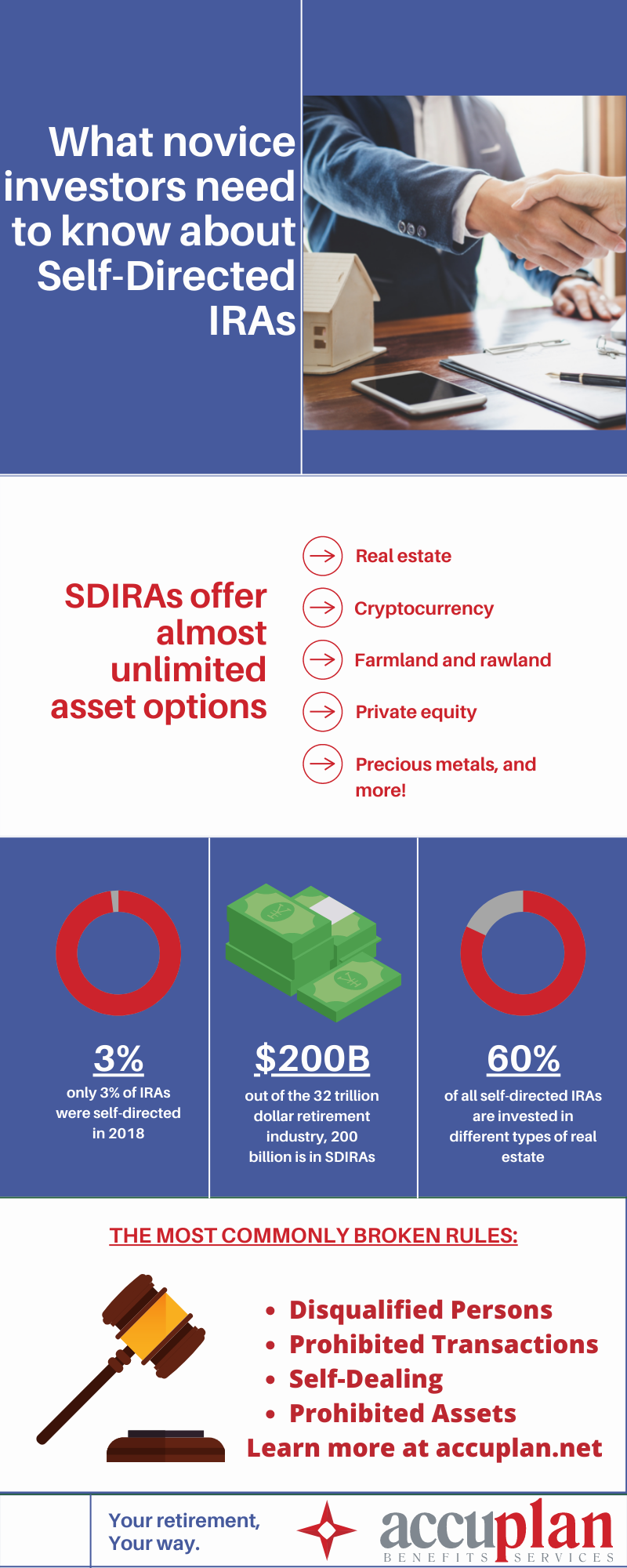

A self-directed IRA is, simply put, a type of retirement savings account that permits you to invest in nearly any type of asset you want using tax-advantaged strategies to do so.

Put simply, an IRA is simply a retirement vehicle. The term self-directed has emerged because so many companies serving as custodians of these accounts have restricted the assets in which account holders and beneficiaries can invest. As a result, when a custodian or administrator permits investors to leverage the entire range of permitted assets, a distinct nomenclature becomes necessary.

Asset Types That Can be Held

It is far, far easier to list the assets that are not permitted in a self-directed IRA than to list the ones that are. This is because the list of permitted assets is nearly limitless. Common types of investments self-directed investors make include:

- Real estate

- Private loans

- Oil and gas rights

- Private equity

- Intellectual property

- LLCs

- Pre-IPO companies

- Databases

- Heavy equipment

- Options

- Cryptocurrencies

- Hedge funds

- Precious metals

- Livestock

- And much, much more

You can leverage your unique abilities, insights, connections, and strengths directly to the benefit of your specific retirement rather than relying on other, uninvested parties to make those investment decisions for you when you use a self-directed retirement account.

Account Types and Options

Self-directed investors may leverage any type of account for which they are eligible but should consult with a professional financial advisor and a tax attorney specializing in these types of accounts in order to determine what type of IRA or combination of IRAs will best serve the investor’s goals when it comes to IRA contribution volumes, IRA contribution limits, and investment strategies.

The IRS specifies four primary types of IRAs:

- Traditional IRA

- Roth IRA

- SEP IRA

- SIMPLE IRA

Traditional and Roth IRAs are individual account types, while SEP and SIMPLE IRAs are built for businesses and their owners.

Rules

There are three vitally important rules for self-directed IRAs to which you must adhere. They are not open to discussion or debate. If you violate these three rules, your IRA will face fines, fees, and penalties that could wipe out the entirety of the capital in that retirement account. Fortunately, these three rules are not particularly complicated even though the results of breaking them are dire. Furthermore, a responsible self-directed investor will always consult an experienced attorney with an extensive background in self-directed investments and self-directed accounts before making any investment or leveraging any new strategy.

Let’s take a look at these important rules:

Rule #1: Do not use capital from your self-directed IRA to purchase prohibited assets

When IRAs were created by Congress in 1974, there were just two types of investments specifically prohibited by that legislation:

- Life insurance

- Collectibles

If you can look at an asset and be definitively certain that you are not investing in life insurance or collectibles, then you are essentially in the clear. However, the definition of collectibles has expanded and evolved over the years. Fortunately, the IRS provides examples of collectibles in IRC Section 408(m)(2). That list currently includes (as of December 2019):

- Any work of art

- Any rug or antique

- Any metal or gem (with limited exceptions)

- Any stamp or coin (with limited exceptions)

- Any alcoholic beverage

Any other tangible personal property that the IRS determines is collectible under IRC Section 408(m)

You’re probably thinking, But what about gold and other precious metals? Well, the IRS permits certain types of exceptions to enable you to hold gold, silver, platinum, palladium, and certain types of coins in your self-directed account. However, there are rules that govern how you hold those assets and who has possession of them.

Rule #2: Do not use your self-directed IRA to benefit a “disqualified person”

The IRS defines a disqualified person at length in the tax code, and those definitions are periodically updated and refined. It is important that you work with a qualified professional who can help you identify whether a party might be a disqualified person before you work with them.

Put simply, a disqualified person is any individual whose benefit might represent some sort of personal benefit to you. Why doesn’t the IRS want these individuals to benefit? Because the tax advantages that come with using an individual retirement account are intended to incentivize you to save for the future, not to generate income in the present. You cannot have your cake and eat it too!

The category of “disqualified person” includes people who are:

- You: the owner of the IRA

- Most of your family, including ancestors, your children, and your children’s children and their spouses.

- Businesses and organizations wherein you or a family member have ownership and/or influence

- IRA account professionals who offer services connected to the IRA.

If you use your self-directed IRA to benefit a disqualified person, the IRS will consider that to be a prohibited transaction and, as a result, your account to be fully distributed.

Rule #3: Avoid doing deals or permitting your self-directed account to benefit any fiduciary or third party

This essentially tells self-directed account holders that just avoiding the letter of the law in terms of committing prohibited transactions with disqualified parties is not enough. It tells you that doing deals with anyone who might have substantial influence over you or your business or over whom you might have substantial influence can put your self-directed IRA at risk. If the IRS were to determine that you had done so, then you would be dealing with a prohibited transaction.

Due Diligence

Defining due diligence

Due diligence regarding investments in private companies means investigating all aspects of the business and the Security being offered. This includes conducting an independent evaluation on whether the statements in the Offering Documents are complete, consistent, and accurate, with no material facts omitted.

Why is due diligence so important?

If you haven’t read “Perspectives on Private Investments and Crowdfunding,” you might refer to it for more background. But, in short, the Securities Act of 1933 has fraud provisions that require the Issuer and its representatives to disclose all material facts accurately and fully.

Red flags

If Issuers are not willing (or not able) to discuss their business in greater detail than is provided in the Offering Documents, even when under the protection of a Non-Disclosure Agreement (NDA) between the Issuer and the Investor, they should be treated with great caution.

The information that has been collected during the due diligence process (i.e. before the investment is made available to Investors) should also be readily available to potential Investors. With the internet, this is relatively easy to do. This information often is provided to prospective Investors via a web-based portal, enabling them to make more informed decisions.