Are you looking for new investment strategies to diversify your retirement portfolio? While traditional investments like stocks and bonds have their place, self-directed individual retirement accounts (SDIRAs) unlock alternative assets, offering new avenues for growth. Weighing the potential benefits and understanding the key considerations of these alternative investments is essential for making informed decisions and building a more resilient retirement strategy.

What Is a Self-Directed IRA?

Diversifying your retirement portfolio with assets beyond traditional investments gives you more control over your financial future. To invest in alternative assets with your IRA, you’ll need to convert your account to a self-directed IRA.

SDIRAs allow you to invest in nontraditional assets related to your unique expertise, values and interests. There are different types of IRAs available. If you’re opening a personal account, the two primary SDIRA types are traditional and Roth. There are additional options for businesses and individuals who are self-employed or own companies.

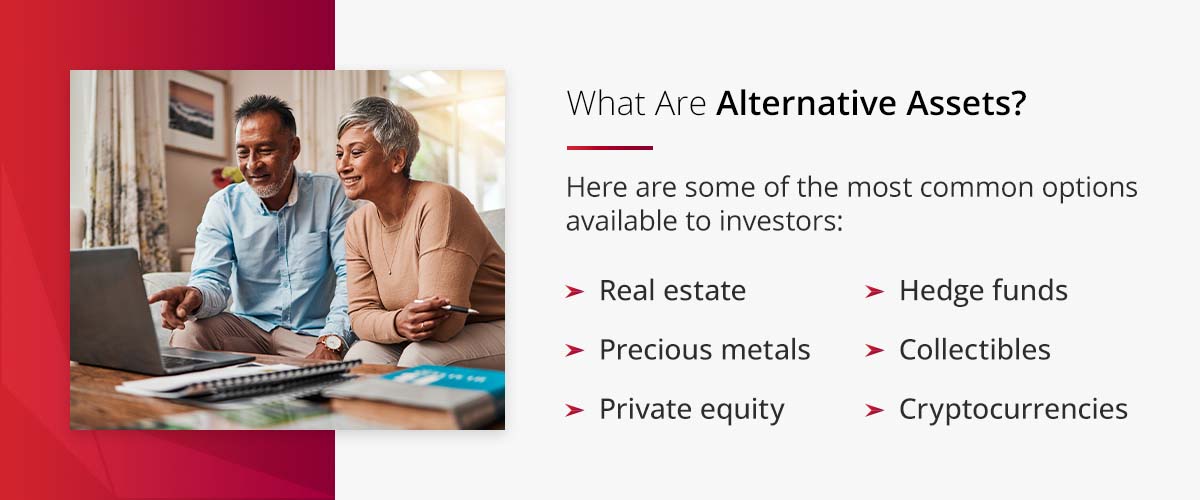

What Are Alternative Assets?

It’s important to understand alternative assets so that you can visualize the possibilities when you choose to self-direct your retirement account. Alternative assets are investments that fall outside the realm of traditional assets like stocks, bonds and mutual funds. Here are some of the most common options available to investors:

- Real estate

- Precious metals

- Private equity

- Hedge funds

- Collectibles

- Cryptocurrencies

5 Reasons to Consider Alternative Investments

Investing in alternative assets has benefits ranging from allowing one to pursue one’s passions to reducing overall portfolio risk. Here are some of the key reasons to invest in alternative assets.

1. Diversify Your Portfolio to Reduce Concentration Risk

Diversifying your portfolio means your assets will be less correlated, meaning they won’t increase or decrease all at once. Spreading out your investments to multiple types of assets can increase stability and security. For example, your real estate investments might hold their value or increase when the stock market declines.

2. Explore New Opportunities Beyond the Stock Market

Investing in alternative assets means your money won’t be completely reliant on the fluctuations of the stock market. While stock markets can earn you capital gains, one of the potential risks of stocks is that prices can fall to zero. However, if you’ve invested in real estate or precious metals, these hard assets will still be worth more than zero even if they are devalued. If you are wary of the unpredictable nature of the stock market, a self-directed IRA is a strong option for you, as it allows you to invest in assets with more confidence.

3. Increase the Tangibility of Your Assets and Enjoy Tax Benefits

Many investors struggle with the abstract nature of stocks and bonds. Being able to see and touch hard assets may increase your confidence in your portfolio. Visiting a property or seeing and holding gold bricks or coins can provide a sense of connection and control over your investments. Plus, by using a self-directed IRA, you can potentially benefit from tax-deferred growth or tax-free withdrawals, allowing your investments to compound more effectively over time.

4. Embrace Higher Volatility for Potentially Higher Returns

Higher risk can yield higher returns, so it’s important to understand your risk tolerance before investing. One of the main benefits of traditional assets is their reliability. Traditional assets move relatively predictably with market protections in contrast to cryptocurrency, for example, which is more volatile. Volatility is both a reason to invest in alternative assets and a reason some investors are deterred. Those who do choose to embrace volatility can earn massive returns.

5. Make Your Portfolio More Interesting and Personalized

Alternative assets can be significantly more interesting and exciting to invest in than stocks and bonds. Many investors find it more fulfilling to put their money into assets related to their unique interests and expertise. You can get creative with your investments and asset management. For example:

- Collect gold coins.

- Flip houses.

- Rent properties.

- Invest in horses for breeding or racing.

- Invest in livestock for agricultural purposes.

- Fund loans to individuals or businesses.

- Explore many other unique investment opportunities.

Frequently Asked Questions About Alternative Asset Management

Here are some frequently asked questions about the risks of investing in alternative assets with your SDIRA, how to mitigate them and how to start investing.

What Are the Potential Downsides of Investing in Alternative Assets?

Diversifying your portfolio can be highly beneficial, but it’s essential to understand some of the risks of investing in alternative assets:

- Illiquidity risk: Stocks are typically easier to liquidate than hard assets like real estate. This potentially limits your ability to access cash on short notice.

- Market risk: Economic downturns, interest rate changes and other broad market factors can negatively impact the value of alternative investments.

- Operational risk: Internal system failures or other management-related issues can pose risks to the performance of alternative assets.

- Regulatory risk: Shifts in laws and regulations can affect certain alternative investments, especially those in evolving sectors like real estate and cryptocurrency.

- Valuation risk: The absence of transparent pricing mechanisms can make it difficult to assess alternative assets’ actual value.

How Can You Mitigate Alternative Asset Risks?

While risks may accompany the many alternative asset benefits, there are also ways to navigate these challenges:

- Diversification: Diversifying your investments can minimize the impact of any single investment’s performance on your overall portfolio.

- Due diligence: Prioritizing research and analysis before committing capital to any alternative investment opportunity can help you make informed choices.

- Hedging: Working with your retirement plan advisor to explore strategies like options contracts can protect your alternative asset investments from potential losses.

- Monitoring and rebalancing: Regularly assessing the performance of your alternative investments and making necessary adjustments can help to maintain your desired asset allocation.

Whether you feel confident in SDIRAs or are still learning, partnering with a trusted self-directed IRA administrator and custodian is key to successful investment. An expert partner can help you avoid compliance issues and provide expert guidance through the investment process.

How Do You Open an Account and Start Investing in Alternative Assets?

You don’t have to know every detail of how to set up a self-directed IRA. A qualified custodian will be familiar with self-directed account rules and regulations and will help you navigate the process. All you need to do is:

- Choose an administrator and a custodian.

- Complete the account application.

- Fund your account.

- Start investing.

Set up Your SDIRA With Accuplan Benefits Services

Accuplan Benefits Services provides self-directed IRA administration and management services. We provide tailored solutions for individual investors and businesses seeking to incorporate alternative assets into their retirement portfolios.

We can help you invest in standard and alternative investments quickly and efficiently. At Accuplan, our team members have years of experience and are trained and well-versed in all aspects of self-directed IRAs. Working with us makes investing simple and even enjoyable, and we’ll always keep your best interests at heart.

Ready to take control of your financial future? Create an account with us or contact us with any questions — we’d love to hear from you!

Disclaimer: Our information shouldn’t be relied upon for investment advice but simply for information and educational purposes only. It is not intended to provide, nor should it be relied upon for accounting, legal, tax or investment advice.