A bear market and high inflation rates have many people wondering if the country is heading toward another recession. Economic activity declines for several months when a recession hits, and sales, income, employment and production tend to drop.

Even if the idea of a recession has you feeling on edge, now isn’t necessarily the time to put your investments on hold. Instead, it might be worthwhile to reconsider where you put your money and your long-term goals. Knowing how to invest during a recession can help protect your wealth for the future and give you some peace of mind about your money.

Is an IRA Safe During a Recession?

An IRA is considered relatively safe during a recession, depending on how it’s managed. Traditional and Roth IRAs, invested in diversified portfolios, can provide stability but may face market volatility affecting stock and bond investments or be impacted by economic downturns, reducing investment returns.

Self-directed IRAs can offer a cushion because they allow you to invest in alternative assets. Overall, a well-diversified IRA with a long-term focus and periodic review can help mitigate recession-related risks and provide a solid foundation for retirement savings.

How to Invest in a Recession

Investing with your IRA during a recession can be a strategic way to protect and potentially grow your retirement savings. Here are some helpful tips to consider:

1. Understand Your IRA Options

The first thing to know is your IRA options because each one has unique characteristics that can impact your investment. Besides traditional and Roth, you can choose between conventional and self-directed:

- Conventional IRA: This type allows you to invest in traditional options like stocks, bonds and mutual funds. Investments beyond these assets are generally prohibited.

- Self-directed IRA: This IRA offers greater investment flexibility. It allows you to invest in alternative assets, like real estate, commodities, precious metals and private equity.

We discuss the benefits of self-directed IRAs during recessions in detail later.

2. Diversify Your Portfolio

Investment diversification involves spreading investment funds across different asset classes and industries. The more varied your assets, the better your portfolio can withstand market ups and downs. Different asset classes respond to recessions differently. Some might fall while others stay constant or even increase in value.

For example, defensive stocks like utilities and consumer staples may perform better during economic downturns. High-quality government and corporate bonds can provide stability and income. Real estate investment trusts (REITs) can also offer exposure to the real estate market and potential income through dividends, but they can be sensitive to economic conditions.

3. Assess Your Risk Tolerance

Remember, there are no guarantees when investing. An asset that seems like it will do well can end up losing money, while one that doesn’t look promising ends up gaining. Thus, in addition to portfolio diversification, it is crucial to assess your risk tolerance carefully. For example, during a recession, stock prices may be volatile, and your investments could fluctuate significantly. Consider your time horizon to make informed decisions.

4. Review and Rebalance Regularly

Monitor your portfolio and assess whether your asset allocation aligns with your retirement goals and risk tolerance. Rebalancing may be necessary to maintain your desired level of risk.

5. Evaluate Your Goals

Before investing during inflation or a recession, evaluating your goals and what you want from your investments is a good idea. You might want to pick more stable assets if you’re approaching retirement. If retirement is still a long way away, consider investing in assets that are more volatile at the moment.

6. Look for Opportunities

Continue contributing to your IRA and invest regularly, regardless of market conditions. This strategy can reduce the impact of volatility by averaging your purchase price. Also, a recession can create buying opportunities for stocks and other assets that lose value. Conduct thorough research to identify potential investments.

7. Maintain an Emergency Fund

Ensure you have enough liquidity outside of your IRA for emergencies. This strategy prevents the need to withdraw from your IRA during market downturns, reducing penalties and potential tax liabilities.

8. Stay Informed and Be Patient

Do not panic or copy others. Large sell-offs of certain assets, such as stocks, might push prices and the market down even further. When you start to feel nervous about your assets, remind yourself to buy low and sell high.

Keep up with economic indicators and market trends. Avoid making impulsive decisions based on short-term market movements. A long-term perspective is crucial for retirement investing.

9. Consult a Trusted Professional

Consider consulting with a professional like a financial advisor if you are uncertain about your investment strategy during a recession. They can provide personalized advice based on your financial situation and retirement goals.

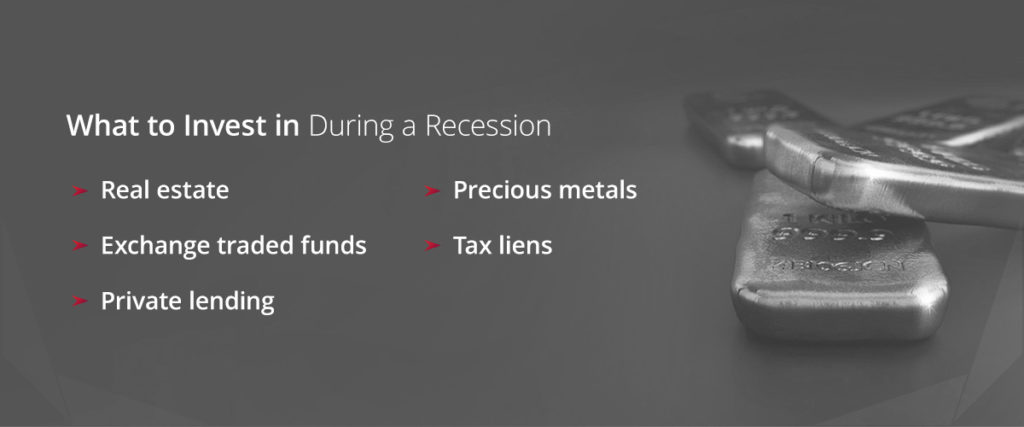

Best Investments During a Recession

There aren’t any hard and fast rules about investing during a recession, so it’s a good idea to speak with a financial advisor if you’re not 100% sure where to put your money. In the meantime, the following assets can be promising if you want a reasonable price and minimize volatility:

1. Real Estate

Real estate can be an appealing investment choice in a recession for several reasons. Depending on the type of property you purchase, it can be a reliable source of rental income. When a recession hits, homeownership often drops while the number of renters increases. People always need a place to live, meaning you will likely find tenants for the property easily.

Recessions can also make mortgages more affordable. Interest rates tend to drop in a recession. Since many mortgages give the option of getting a fixed interest rate, the cost of your property loan will decrease over time due to inflation.

If you want to invest in real estate using a self-directed IRA, there are some rules to remember. The IRA owns the property — not you — and you’re prohibited from spending even one night in it. You cannot lease the property to your spouse or any direct descendants.

2. Exchange Traded Funds (ETFs)

If you want to keep some of your money in the stock market during a recession, you might be able to take advantage of reduced stock prices. Known as buying in the dip, buying stocks in a downturn when share prices are low can mean greater gains later.

One way to purchase stocks while keeping your portfolio relatively diverse is to buy ETFs. An ETF is a collection of securities that trade on the exchange. Many track indexes and contain a diverse assortment of assets, such as stocks or bonds. When you buy an ETF, you buy a portion of the fund but not the assets themselves.

ETFs offer several advantages, such as reduced costs and ease of diversification. They aren’t without their drawbacks, though, such as the fact that the fund could lose value. Some ETFs can be illiquid or hard to sell.

3. Private Lending

Banks often tighten their lending requirements in a recession, making it more challenging for some individuals or businesses to get a loan. Stricter lending requirements can mean people who invest in private lending see a greater return.

With private lending, you lend money to others through your IRA. You set the loan terms, such as the interest rate and repayment length, and decide how much to lend to a borrower.

Private lending does have some risks, notably the risk of a borrower defaulting on the loan. To minimize risks, review each application carefully before making a lending decision.

4. Precious Metals

When the stock market is down, investors often turn their attention to precious metals such as gold and silver. If you want to invest in precious metals, you can buy actual coins or metal bars of gold or silver. Alternatively, you can purchase shares of a precious metals fund.

Since precious metals tend to become more prevalent during economic downturns, you might pay a higher price for them in a recession than at other times.

5. Tax Liens

When you invest in tax liens, you purchase a claim on a property that’s behind on its taxes. During a recession, it is common for property owners to fall behind on taxes, meaning there might be more tax liens available. Once you become the holder of the tax lien, one of two things can happen:

- The property owner can pay the taxes due plus the interest. In this scenario, you would get the money as the lien holder.

- If the property owner doesn’t pay the taxes owed by the deadline, the lien holder receives the deed. You’re then responsible for paying the taxes and interest.

Investing in tax liens can be a relatively affordable way to invest in real estate.

Why You Need a Self-Directed IRA to Invest During a Recession

Self-directed IRAs can provide several benefits during an economic downturn, including the following:

1. Greater Investment Flexibility

A self-directed IRA lets you invest in alternative assets unavailable in traditional IRAs. This diversification can help cushion your portfolio against stock market volatility during a recession. You can select investments that align with your risk tolerance and financial goals.

2. Potential for Higher Returns

A self-directed IRA can help you capitalize on assets that become undervalued during a recession. Also, you can invest in assets like real estate that may offer better stability than traditional investments. With many investment options, you can develop a strategy that potentially yields high returns over time.

3. Control Over Your Investment

Self-directed IRAs allow you to make your own investment decisions. This control is crucial during uncertain economic times since you can respond quickly to market changes and seize opportunities depending on asset liquidity.

4. Protection Against Market Volatility

Physical assets like real estate and precious metals can serve as a hedge against inflation and currency devaluation. However, you cannot invest in these assets with traditional IRAs — you need a self-directed IRA. Income-generating assets like rental properties can provide a steady income stream even when other investments are underperforming.

5. Tax Advantages

Self-directed IRAs have tax advantages like other IRAs. Traditional self-directed IRAs grow tax-deferred, meaning you only pay taxes when you withdraw funds in retirement. This feature is ideal when you invest in appreciating assets during a recession. However, qualified withdrawals in Roth self-directed IRAs are tax-free. You can benefit if you make profitable investments during a recession.

6. Potential for Alternative Strategies

You can use creative financing methods like seller financing to acquire properties without significant upfront capital. This feature can be advantageous during a recession when cash flow is tight.

7. Long-Term Perspective

Self-directed IRA encourages long-term investment strategies. Instead of reacting to short-term market fluctuations, you can focus on long-term investment goals.

Why Should You Open a Self-Directed IRA with Accuplan?

Accuplan is the best place to open a self-directed IRA for the following reasons:

1. Industry Knowledge

Accuplan has years of experience in the self-directed retirement account industry. Our team is well-versed in the rules and regulations governing IRAs. We can help you navigate the complexities with ease and confidence.

2. Diverse Investment Options

With our self-directed IRA, you can invest in various alternative assets. This diversity enables you to tailor your portfolio to your interests and risk tolerance.

3. Personalized Retirement Strategies

Having years of experience enables us to understand the needs of different investors. We work with clients to develop personalized retirement strategies that align with individual objectives, risk tolerance and investment preferences. We also provide educational resources to help broaden your knowledge.

4. Regulatory Compliance

Accuplan maintains compliance with IRS regulations. We help clients avoid pitfalls and penalties associated with self-directed investing. You can leverage our expertise to ensure that your investments are structured correctly within the framework of the IRS guidelines.

5. Exceptional Client Support

We pride ourselves on exceptional customer service. Our team is readily available to support and answer questions that may arise. We are responsive and provide a user-friendly platform for managing investments.

6. Security and Trustworthiness

Accuplan is a trusted custodian for self-directed IRAs. Opening an account with us provides peace of mind. We have a solid reputation in the industry for our transparency and security.

How to Get Started

Opening a self-directed IRA account with Accuplan is simple and can help you prepare for a recession. Here are the steps:

- Choose your IRA type: Decide which self-directed IRA you prefer — traditional or Roth.

- Complete the application: Visit Accuplan’s website and complete the online application form with your personal information.

- Select your investment: Choose your preferred investment asset, such as private placement, real estate or precious metals.

- Fund your account: You can transfer funds from existing retirement accounts or make direct cash contributions.

- Review and finalize: Review the account documents to ensure all information is accurate and complete.

- Begin investing: You can start investing once your account is funded. Remember to follow the IRS guidelines.

Our team provides ongoing assistance to help you manage your account.

Frequently Asked Questions

Here are answers to some commonly asked questions:

What Assets Go Up in a Recession?

It is difficult to predict which assets will go up during a recession. However, some tend to perform better than others. Ideal options include defensive stocks, precious metals, real estate and high-quality bonds.

Should You Withdraw Your IRA Funds During a Recession?

Withdrawing funds from your IRA during a recession is generally not advisable unless necessary. If you have a long-term investment horizon, it is usually better to ride out market fluctuations. Additionally, withdrawing funds early often brings penalties.

Can You Still Contribute to Your IRA During a Recession?

Yes, you can continue contributing to your IRA during a recession, provided you stay within the annual contribution limits set by the IRS. Consistent contributions can help you take advantage of dollar-cost averaging by purchasing lower-priced assets.

Access the Best-Performing IRA Assets With a Self-Directed Account

If you want to look beyond the stock market when planning for your retirement, a self-directed IRA might be right for you. Self-directed IRAs are ideal for people interested in investing in alternative assets, such as real estate, precious metals or tax liens. Accuplan has extensive knowledge of the self-directed IRA process and an investing platform that’s user-friendly and intuitive. Contact us today to learn more!

This information shouldn’t be relied upon for investment advice. It is for information and educational purposes only. It is not intended to provide, nor should it be relied upon for accounting, legal, tax, or investment advice.