Airbnb property investments are popular because there are many ways to invest and make the properties unique. Whether you’re renting out your personal home or using your retirement account to invest in a new property, Airbnb rentals have the potential to generate consistent income. So, how do you invest in Airbnb property? Learn more about how to buy an Airbnb property and use self-directed IRAs to invest in and run a short-term rental property.

How to Invest in Airbnb Property

While investing in real estate has always been common, Airbnb properties have recently become popular among financial investors. You can take many avenues to invest in or open an Airbnb property. For example, many Airbnb hosts list their personal properties as short-term rentals when they aren’t home or make their guest houses available for rent. This can be a great way to make a little extra income on the side, especially if you live in an area where many people need travel accommodations, like near beaches or sports arenas.

If you don’t already own a property that can be rented out or cannot rent out your current property, you have other investment options. You can use a loan to purchase a property with the intent of renting it out. Then, you would use the income from short-term rentals to pay back the loan. Once the loan is paid off, you can pocket the income or use it for property upgrades.

When investing in Airbnb property, first consider your current financial situation to determine your best investment route. Certain investment options will work for some people and not others. Consider consulting with a financial advisor to determine your best options.

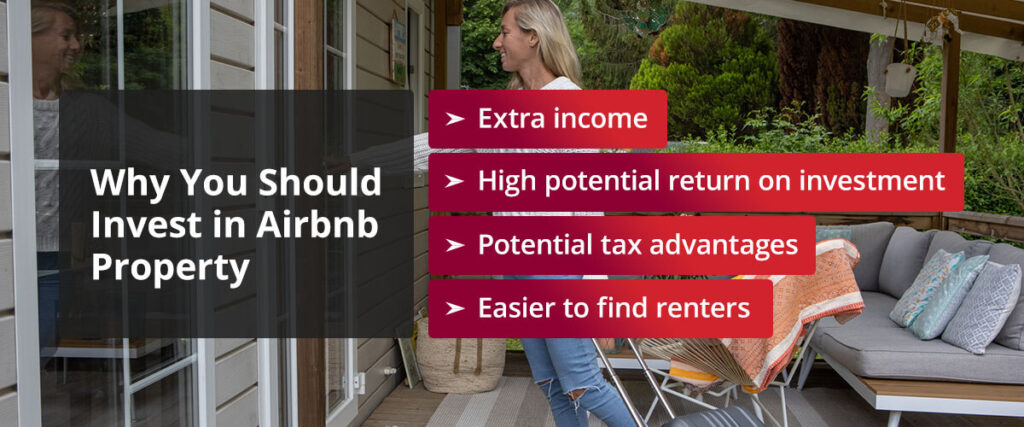

Why You Should Invest in Airbnb Property

Investing in an Airbnb property offers various potential benefits, especially when compared to traditional rental properties. Explore how investing in Airbnb property can be worthwhile.

- Extra income: One of the biggest potential benefits is the extra income you can generate through short-term rentals. Many Airbnb owners use their rental properties as a passive source of income, meaning they can earn money without expending lots of energy. Depending on your rates, location and investment route, you could generate substantial income from your investment property.

- High potential return on investment: Of course, paying back your loan must happen before you see a return on investment. However, Airbnb properties can potentially have a high return. Keeping your Airbnb consistently occupied throughout the year helps increase any extra income.

- Potential tax advantages: You may be able to take advantage of some tax benefits when investing in an Airbnb. Since you’re investing your money into it, many costs associated with properties can be written off on your federal taxes. For example, you could write off the cost of repairs, maintenance and upkeep, property taxes, insurance, mortgage interest, and other similar costs.

- Easier to find renters: The Airbnb platform makes it easier to find potential short-term renters. You’ll also find a more diverse range and a larger number of renters, increasing your likelihood of booking more stays.

How to Purchase a Self-Directed IRA Rental Property

In addition to the traditional rental property investment avenues listed above, you could also use investments like your retirement accounts to invest in rental properties. For example, you can use your self-directed individual retirement account (IRA) to purchase an Airbnb property. The process varies from traditional investment methods, so here’s how to start.

1. Open a Self-Directed IRA

If you don’t already have a self-directed IRA, you’ll need to open one. Some restrict what types of investments can be made with the account, so look for brokers that allow IRA real estate investments. Once you find a broker that suits your needs, you can open an account. Keep in mind that there may be fees associated with opening an account, and you’ll need to contribute to the account before making any investments.

2. Purchase Property Through the Self-Directed IRA

Once your self-directed IRA is set up and has funds, you can begin looking for potential rental properties to purchase. When you find a property you want, you’ll purchase the property through your self-directed IRA, using those funds rather than a standard loan. Purchasing a property through your IRA means the investment will sit in your IRA, and any earned money from the property stays in your IRA.

3. Get on Rental Platforms

Sign up to host through platforms like Airbnb and VRBO to start booking guests in your newly owned rental property. These platforms allow guests to find your property, communicate with the property manager and conveniently book a stay through the website or app. Platforms like Airbnb are often the best way to regularly book guests at your property, especially when considering some of the rules associated with having a self-directed IRA rental property.

4. Grow Your Self-Directed IRA Funds

The more renters you have, the more you’ll grow your self-directed IRA funds. If you’re looking for a passive way to grow your retirement funds through investment, Airbnb rental properties through your IRA make it easy to build your account with minimal effort.

Understand the Rules of Having a Self-Directed IRA Airbnb

The Internal Revenue Service (IRS) has specific rules for self-directed IRAs and Airbnb investments, including who receives the benefit, your level of involvement in the property and when taxes apply. Here’s what you need to understand about self-directed IRA rental properties to comply with the IRS.

Unrelated Business Income Tax (UBIT)

Typically, you can deposit money into your IRA and get a tax deduction for that deposit. The money your IRA earns through interest is tax-free until taken out for retirement. However, you may be subject to the UBIT when investing in your self-directed IRA. The IRS requires taxes to be paid on the income from certain investments in your self-directed IRA. For rental properties like Airbnb, you may have to pay taxes on some of the income going into your IRA.

Long-term rentals are exempt from UBIT — for example, if you rent your property to the same tenant for six months, you may be exempt. However, short-term rentals of seven days or less, or 30 days or less with personal services, will usually be taxed. Personal services include convenience services like a maid or chef being present during someone’s stay on your property. In some cases, like excluding personal services or booking stays longer than seven days, you may be able to avoid UBIT with short-term rentals.

Disqualified Person(s)

The IRS also has rules determining who receives the benefit when holding investments in your self-directed IRA. When investing in Airbnb properties, your IRA receives all the benefits since it’s holding the asset. This means you and anyone else involved in your IRA, like your spouse, children or business partners, become disqualified persons. As a disqualified person, you cannot receive investment benefits. If you’re holding a rental property in your self-directed IRA, it can only be for investment purposes.

As such, you and other disqualified persons cannot live on or rent out the property to yourselves. For example, you wouldn’t be allowed to take your personal vacation at the Airbnb in your self-directed IRA. This also means that you and other disqualified persons cannot directly manage or work at the property. You may consider hiring a property manager to ensure you keep your distance.

Where the Income Goes

Since you’re a disqualified person and the investment property is held in the self-directed IRA, your IRA is considered the owner of the Airbnb. As such, any income generated through the Airbnb property goes directly back to your IRA account. This means that instead of pocketing the income from your investment, you’re using the rental property to build your retirement funds.

Understanding these rules and potential taxes of holding an Airbnb property in your self-directed IRA helps you make informed investment decisions and remain IRS-compliant.

Benefits of a Self-Directed IRA Airbnb

As long as you comply with the IRS rules regarding Airbnb rental properties, this type of investment can be beneficial to hold in your self-directed IRA. Here are a few benefits of safely using a self-directed IRA to invest in an Airbnb property:

- More flexibility in your investment decisions: This investment method varies from traditional investments, giving you more flexibility and variety across your investments. This factor is especially beneficial if you want to expand your investment portfolio.

- A steady stream of retirement account deposits: If you’re looking for an easy way to deposit consistently in your retirement fund, Airbnb rental properties can provide a steady stream of funds into your account. The more you can book stays at the property, the more consistent the deposits will be.

- Passive source of funds: Since the IRS requires you to be mostly hands-off when holding an Airbnb in your self-directed IRA, this investment can provide an effective source of passive retirement funds. Hiring a property manager ensures your property runs smoothly while your IRA simply collects the income, all with minimal to no effort on your end.

How to Start an Airbnb Business

When considering an Airbnb investment, researching and understanding your investment options is important to make the right decision for your financial situation. Investing through your self-directed IRA may not fit your needs, so be sure to consider this option carefully. Regardless of how you make this investment, once it’s made, you’ll have some work to do to prepare your Airbnb property for guests.

You have much to consider when starting an Airbnb or other short-term rental property, especially right after making the initial investment. From listing the property on rental platforms to making stays comfortable and convenient for guests, there’s much to do when starting out. To help, here are some tips for starting and running an Airbnb or similar rental service.

1. Prepare the Space

First things first, you need to furnish the property. Depending on the state of the property when you purchase it, you may need to handle tasks like painting, remodeling or repairing to get the space ready. When preparing the space, consider doing a theme or giving it your personal touch to make it unique. Fun decorations, elements and aesthetics can create a memorable experience for your guests.

2. Take and List Photos

Once the property is prepared, and you’re listing it on short-term rental platforms, take photos of all the interior and exterior spaces your guests can access during their stay. Listing photos in order so it looks like you’re walking through the house when viewing the photos is the best way to present them online. This gives potential renters the best view of the property and helps them decide if your space is a good fit for them.

3. Set Prices

Before officially listing your Airbnb, you should consider a pricing strategy. Short-term rental prices fluctuate depending on the market, so you may need to adjust your prices accordingly. When setting your prices, also consider the property’s location. Properties in areas with high demand — like at the beach or near lots of activities — may have higher prices. The property size, number of beds and bathrooms, and on-site amenities can also affect your prices.

4. Anticipate Guests’ Needs

Anticipating your guests’ basic needs allows you to stock the house with supplies. Start with the basics, like toilet paper, hand soap, dishes, utensils, trash bags and other necessities. Some Airbnb hosts also provide items like shower supplies and linens. These types of items can enhance a guest’s stay and make things more convenient — just remember that offering items like linens means you have to get them cleaned between stays.

5. Keep the Property Clean

On that note, consider hiring a cleaning service that will come in after each rental to clean the property and prepare it for the next guest. Hiring a cleaning service takes a lot of responsibility and stress off your plate — and is even necessary when investing through a self-directed IRA since you can’t personally work on the property. Guests expect cleanliness, so always keep the property clean and restocked.

6. Use Keypad Doorknobs

Another convenience feature worth adding to your property is a keypad doorknob for the front entrance. Rather than exchanging keys or worrying about them getting lost, a keypad lock allows guests to check themselves in and out of the house. Keyless systems also allow you to change the door code between guests to increase security and ensure the current renters are the only ones who can access the space.

Carefully Invest Your Self-Directed IRA With Accuplan Benefits Services

Using your self-directed IRA to invest in real estate can be challenging to understand, especially when doing it for the first time. While there are general rules to follow with any investment, certain types of investments, like rental properties, have specific rules you must also follow.

At Accuplan, our employees have years of niche industry experience to help you fully understand your self-directed IRA and how to comply with the IRS code. We’ll help you prevent disqualifying your account’s retirement status and make informed investment decisions. Open a self-directed IRA today or contact us for a consultation.

*Our information shouldn’t be relied upon for investment advice but simply for information and educational purposes only. It is not intended to provide, nor should it be relied upon for accounting, legal, tax or investment advice.