A self-directed IRA is an alternative way to save for your retirement. With this account, you have additional investment assets to choose from, allowing you to diversify. While self-directed IRAs offer more possibilities, they also require you to take the initiative and do your due diligence.

Understanding the fees for a self-directed IRA can be challenging for two primary reasons. First, the custodial charges may vary. Second, the platform and fee structure have different rates, which can be cumbersome to compute and track. The charges on your account directly impact your investments, so it helps to learn about the expenses you may incur when choosing a custodian.

Custodians that offer flat rates are preferable because their fee structures are straightforward. Also, they tend to generate more returns — the fee remains consistent, even when your assets grow.

What Are Self-Directed IRA Fees?

Self-directed IRA fees are the various charges you incur when saving for retirement. Fees can affect your investment portfolio, so it helps to know what to expect from the beginning. But how do you track your expenses?

You may look at your account opening documents, confirmations, account statements and any other record that provides information about the investment. When in doubt, ask the investment professional to clarify all associated charges. For example, ask about the fees you may pay for purchasing, holding or selling an investment, whether you must keep a minimum account balance to avoid charges or if there are any costs for secondary transactions.

Since some companies may charge a hefty setup fee or take a percentage of asset value, it’s essential to learn about the types of accounts.

What Are the Types of Self-Directed IRA Accounts?

There are two types of self-directed IRA accounts.

1. Self-Directed IRA

In a classic self-directed IRA, all transactions go through the custodian. The custodian holds the investments within the accounts, buys and sells according to the account holder’s instructions and complies with all IRS reporting requirements. Self-directed IRA accounts generally charge low setup and transaction fees, at either an asset-based or flat quarterly rate.

2. Self-Directed IRA LLC

A self-directed IRA LLC, aka a “checkbook IRA,” is a self-directed account with checkbook control. This option allows the account holder to transact without going through the custodian. You set up a checkbook IRA by establishing either an LLC or trust for your IRA, followed by a business checking account.

You can issue checks and perform electronic transactions related to your investments without creating a prohibited transaction or personally touching the funds. A self-directed IRA LLC may charge higher setup fees and an LLC state fee, depending on where you live, but generally relieves you of asset-based or transaction fees.

What Fees Does a Self-Directed IRA Have?

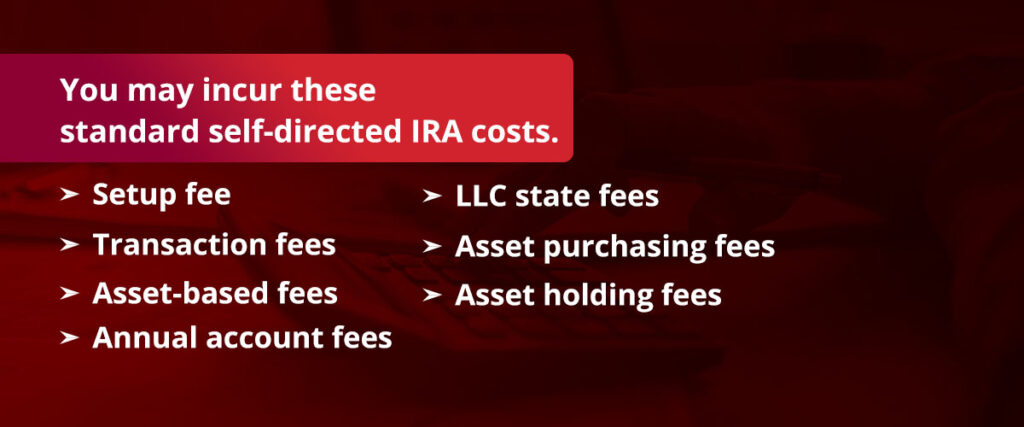

You may incur these standard self-directed IRA costs.

- Setup fee: You’ll pay the custodian a one-time fee for creating a self-directed IRA account.

- Transaction fees: The custodian charges for executing transactions on your behalf. The charges differ among custodians, so it’s best to clarify this at the beginning of your relationship. Also, check the agreement to understand when and how transaction fees may change.

- Asset-based fees: Investment companies may charge customers a percentage of the assets they manage.

- Annual account fees: The custodian charges this fee for maintaining the account. It is usually annual and may increase depending on your agreement.

- LLC state fees: Self-directed IRA LLCs have varying state fees.

- Asset purchasing fees: The custodian charges this fee when they provide the investment asset. Typically, such arrangements have an increased markup on the purchase price.

- Asset holding fees: Assets like precious metals, including gold, may attract a storage fee from the depository. The custodian usually passes this charge on to the account holder.

How to Compare Self-Directed IRA Fee Schedules

Every penny counts when saving for retirement, so weigh your options and choose a custodian that fits your plans and expectations. Here is an IRA fee comparison strategy you can use to determine if a company has a reasonable fee schedule.

1. Contact Multiple Custodians

The first tip when comparing self-directed IRA custodian fees is to ask several companies what they charge. Since these costs directly impact your investment, you want to be confident you are getting fair rates. The best custodians have a transparent fee structure that is easily accessible on their websites. Contact the custodian for clarification about their pricing if you have questions.

2. Collect Information on the Fee Structure

While some custodians offer flat fees, others charge on a tiered or percentage-based system. It’s wise to choose a company that charges flat rates, because you’ll pay the same fees no matter how much money you have in your account. There is no need for a calculator.

Percentage-based fees can eat into your returns and are generally challenging to compute and track, which can be inconvenient. Custodian charges based on the number or value of assets create an anti-incentive by discouraging account holders from growing their assets.

3. Choose a Fee Schedule That Fits Your Plans

After reviewing the fee structure and other associated charges, select the one that best fits your preference. Choosing a custodian with a simple, understandable payment structure helps you plan your investment and eliminates uncertainty. Remember, the goal is to maximize your returns, so partner with a custodian committed to guiding you from beginning to end.

Additional Tips for Selecting the Right Self-Directed IRA Fee Structure

When assessing IRA custodial fees, consider the type of asset chosen for the investment and the selected management structure. Let’s consider some examples.

- Real estate with direct management: Any platform offering checkbook control is best if you decide to purchase and manage a property independently. Real estate management typically attracts large sums of money, so you want to select a platform with minimal transactional charges.

- Real estate in private placement: A self-directed IRA can be ideal for real estate in a private placement due to the low setup fee. You may pay fewer transaction fees since the property is within a private placement. To maximize returns, choose a custodian that charges a flat rate, since the asset or its value is likely to appreciate.

- Startups or crowdfunding ventures: The account you choose depends on your involvement in the investment when dealing with crowdfunding ventures or startups. For example, if you intend to write checks but leave management to a third-party company, like in the case of a private placement, you may choose a low-priced self-directed IRA custodian.

Partner With Accuplan for the Best Fee Schedule

Accuplan Benefits Services is a leading provider of self-directed IRA administration with decades of experience in the industry. Our team of dedicated and experienced professionals has helped thousands of investors succeed. We offer flat fees at competitive rates. Contact us now to learn more!

Our information shouldn’t be relied upon for investment advice but simply for information and educational purposes only. It is not intended to provide, nor should it be relied upon for accounting, legal, tax or investment advice.