If you have an existing individual retirement account (IRA) but want to be able to invest in a broader array of assets, consider rolling your funds into a self-directed IRA (SDIRA). An SDIRA allows you to access alternative assets that aren’t available with standard IRAs. You can invest in real estate, cryptocurrency and private equity. You also have more control over your investments and the potential for higher returns.

As with all IRAs, an SDIRA is tax-advantaged, with tax-deferred or tax-free options. Transfers and rollovers for self-directed IRAs are tax-free and can be freely completed without a limit so long as the money goes directly from one retirement account to another.

One of the most common reasons for a rollover is a former employee not wanting to leave their contributed assets behind with the former employer. The second most common reason is wanting to take full advantage of the tax savings, or third, to simply consolidate assets.

Learn more about how to rollover an IRA to a self-directed IRA in this guide.

Understanding the Types of IRA Rollovers

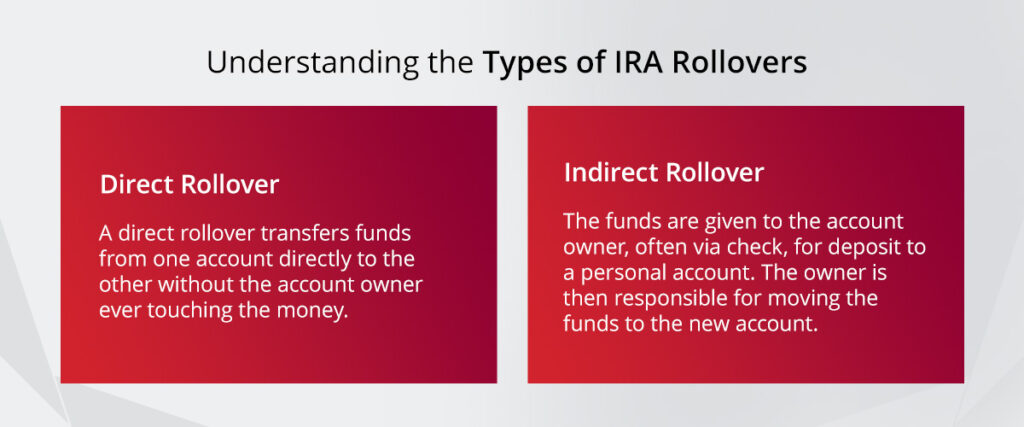

Rollovers are the most common way to transfer funds within retirement accounts. Rollovers are transactions that allow for the movement of assets between retirement accounts. There are two types of rollovers — direct and indirect. Let’s go over the basic terminology.

Direct Rollover

As its name implies, a direct rollover transfers funds from one account directly to the other without the account owner ever touching the money. It’s often used to move funds from a former employer 401(k) to an IRA, but it can also be used to transfer funds between retirement accounts, such as moving to a new IRA provider.

With a direct rollover, your current plan administrator sends the money directly to the new administrator or custodian. Because you never take possession of the funds, there are no withholding, tax consequences or penalty fees.

Indirect Rollover

In an indirect rollover, the funds are given to the account owner, often via check, for deposit to a personal account. The owner is then responsible for moving the funds to the new account. They have 60 days to deposit the funds into the new IRA. If they miss the deadline, they must pay taxes and penalties on the full amount.

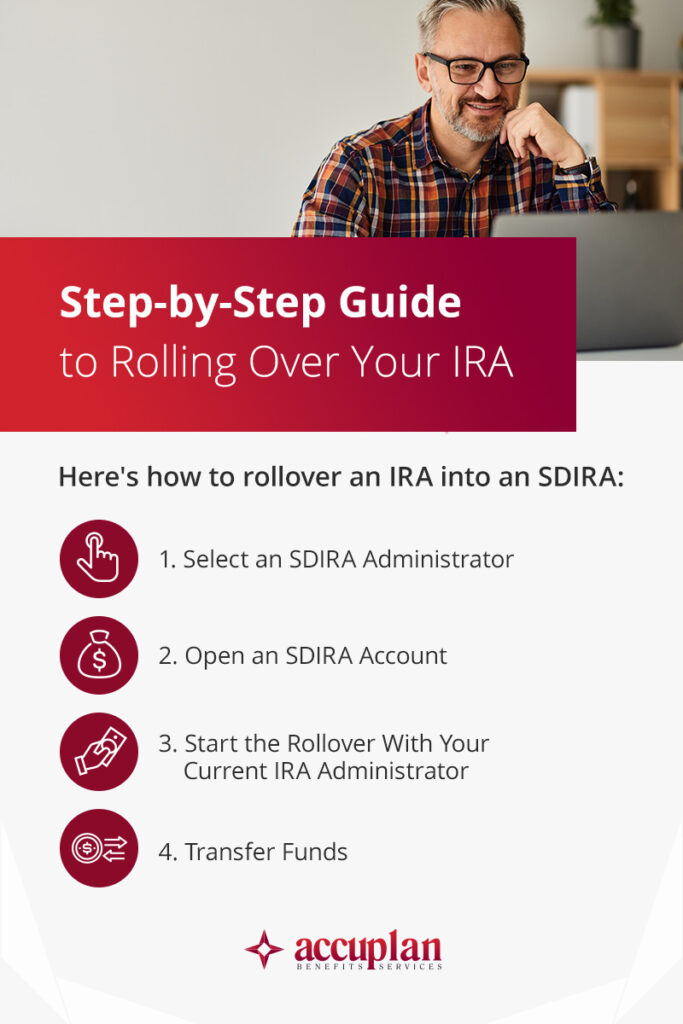

Step-by-Step Guide to Rolling Over Your IRA

Here’s how to rollover an IRA into an SDIRA:

1. Select an SDIRA Administrator

The first step is finding a self-directed IRA administrator. Research a few different companies to find a good fit. Most companies are only administrators or custodians. Some companies are both. Administrators handle the administrative tasks and are an intermediary between the count owner and the custodian, who holds the assets. A custodian is usually a bank or trust company.

Look for companies specializing in the types of alternative assets that interest you. You might ask your financial advisor, attorney or accountant for recommendations. As you evaluate companies, check their credentials and reviews in addition to their fees and services.

2. Open an SDIRA Account

After you’ve picked an administrator, you’ll open an SDIRA account with them. The information required may vary by administrator, but you’ll typically need to provide:

- Your Social Security number

- Your date of birth

- Your address

- Beneficiary information

- Details about your existing IRA

Most applications can be completed online for a faster, paper-free process.

3. Start the Rollover With Your Current IRA Administrator

Contact your current provider and inform them you want to roll your funds into a different account. They will likely have a transfer form for you to fill out. If you have the option, a direct rollover is almost always better than an indirect rollover.

Fill out any paperwork carefully and review it for accuracy and completeness before submitting it. You should keep a copy for yourself, and you may need to send a copy to your new SDIRA provider.

4. Transfer Funds

For a direct rollover, find out when your provider will transfer the funds and track the process to ensure it’s done in a timely manner.

For an indirect rollover, you’ll receive a check from your current custodian. Be sure to deposit the check into your SDIRA account within 60 days. If the administrator withheld taxes, you must make up the withheld amount to avoid penalties.

Either way, confirm with your new SDIRA that they have received the funds and check your account statement to ensure the correct amount was credited to your account.

Tax Implications of a Self-Directed IRA Rollover

Rolling funds into an SDIRA can have tax consequences if you don’t adhere to IRS regulations. Following the rules carefully can help you avoid these common tax pitfalls:

IRS 10% Additional Tax on Early Withdrawals

To encourage people to wait to access their savings until retirement, the IRS charges an additional tax as a penalty on most early distributions from retirement accounts. If you haven’t turned 59 ½, distributions are generally considered cash withdrawals and are subject to a 10% tax. There are some exceptions, such as for disaster recovery, depending on the account type.

60-Day Rollover Requirement

One of the most important self-directed IRA rollover rules is the 60-day requirement. This rule is applicable if you make an indirect transfer from one account to another.

When you take a distribution, you can deposit the same amount into another IRA within 60 days to avoid the early withdrawal penalty. If you receive funds from your current IRA administrator, be sure to redeposit them into another qualifying account promptly. Otherwise, you will be subject to applicable taxes and penalties.

Your administrator may withhold funds to pay taxes. If they did, you must deposit that amount as well since it still counts as a distribution.

Traditional to Roth

With a traditional IRA, you contribute pretax money and pay taxes when you take distributions in retirement. In contrast, you fund a Roth IRA after paying taxes, meaning withdrawals are tax-free.

Rolling from a standard into a Roth account will mean you have to pay taxes since your contributions were pretax and Roth accounts are funded post-tax but grow tax-free. If you want to transfer funds from a traditional IRA to a Roth SDIRA, you can convert your existing account first and then rollover funds to the new SDIRA, or you can open a traditional SDIRA and convert it to a Roth SDIRA after funding it.

Open a Self-Directed IRA With Accuplan Benefits Services

Choosing an SDIRA comes with many benefits, but there are challenges to be aware of. Partnering with the right provider can make all the difference.

Since 1985, Accuplan has helped people plan their futures. Our experts are dedicated to helping you understand IRS regulations for all types of investment and retirement accounts. Contact us for more information about our services, including SDIRAs, or open an account today!

Our information shouldn’t be relied upon for investment advice but simply for information and educational purposes only. It is not intended to provide, nor should it be relied upon for accounting, legal, tax or investment advice.