If you have a retirement account or plan to open a new one, you want to maximize your post-retirement quality of life and protect the legacy you leave after your lifetime. This involves understanding your tax obligations and leveraging strategies to retain more of your wealth. One of the best ways to grow and retain your wealth is with a self-directed IRA (SDIRA).

Some investors who use or are considering an SDIRA are uncertain about the tax implications — especially unrelated business income tax (UBIT). This guide explains UBIT and how to make the most of an SDIRA for tax-advantaged retirement savings.

Understanding UBTI and UBIT Tax

Unrelated business taxable income (UBTI) is the portion of income subject to tax, while the tax on unrelated income itself is called unrelated business income tax (UBIT). These two concepts are related but different. Both are relevant when a tax-exempt entity like an SDIRA earns income from business activities unrelated to the reason for that entity’s being tax-exempt.

For example, an SDIRA is tax-exempt because of its structure and purpose as an individual retirement savings tool. To generate more retirement savings, SDIRA owners can form or buy a limited liability company (LLC) like a carwash. But that carwash is a for-profit business and its activities are not directly related to saving for retirement. Because the income our hypothetical carwash generates is unrelated to the SDIRA’s reason for being tax-exempt, it comes with a tax obligation.

UBTI vs. UDFI

Like UBTI, unrelated debt-financed income (UDFI) is subject to UBIT. UDFI refers to income a tax-exempt entity like an SDIRA generates from owning property that it finances through debt, like a mortgage. UBIT applies to the portion of UDFI attributable to debt, meaning it’s less when your SDIRA owns more of the property outright and more when a greater part of it is financed through debt..

Do I Owe UBIT Tax on My Self-Directed IRA?

If your SDIRA has an asset like a business generating UBTI, the SDIRA likely owes UBIT on that income. Other activities like real estate flipping and extensive private lending can also incur UBIT. But remember that only a portion of the income your assets generate is UBTI, and only a portion of your UBTI will go to UBIT. Thanks to exemptions and deductions, much of your SDIRA’s income could be non-taxable, and the financial benefits of investing in assets like businesses and real estate could be much greater than the cost of UBIT.

Additionally, keep in mind that UBIT is a tax to account for rather than a penalty to avoid. Generating UBTI is a valid part of your SDIRA investment strategy, as long as you pay any UBIT you owe.

How to Calculate UBTI and UBIT Tax for Your IRA

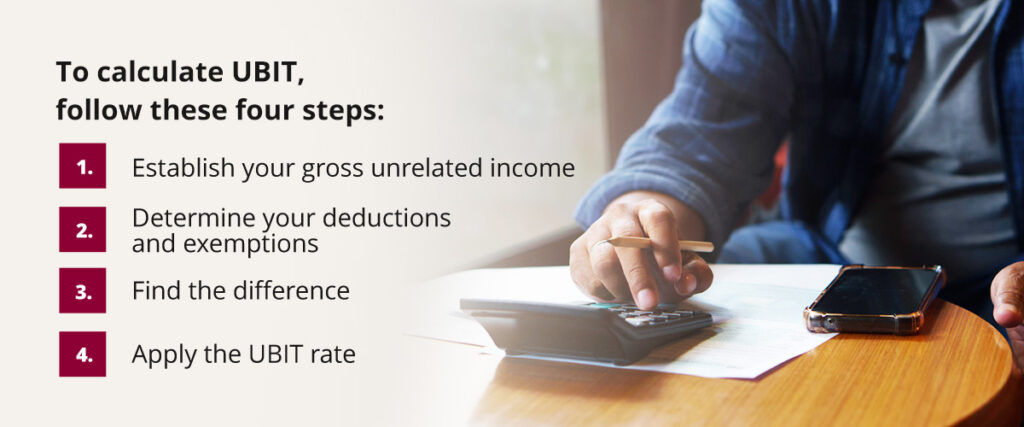

To calculate UBIT, follow these four steps:

- Establish your gross unrelated income: Start with the total annual income in your SDIRA that’s unrelated to the SDIRA’s purpose of individual retirement savings. Include your gross unrelated income from debt-financed property, if any. If the total is $1,000 or more, your SDIRA must file IRS Form 990-T and pay any UBIT you owe. Your SDIRA must get its own federal employer identification number (EIN) to file for UBIT.

- Determine your deductions and exemptions: For UBTI, these include business operating expenses, royalties, interest and dividends. For UDFI, exclude a part of the gross income proportionate to how much of the property your SDIRA owns outright. For example, if it has paid off 30% of the property while 70% remains debt-financed, only 70% of the gross UDFI is subject to UBIT.

- Find the difference: Subtract total deductions and exemptions from gross unrelated income. The resulting difference is your total income subject to UBIT.

- Apply the UBIT rate: UBTI is taxable at corporate rates, so consult the latest IRS corporate income tax table to determine your UBIT rate. Apply this rate to your net UBTI to determine the amount of UBIT you owe.

Maximizing Tax Advantages With Your Self-Directed IRA

While an SDIRA can be subject to UBIT, it remains a powerful retirement savings tool with significant tax advantages. Here are six ways you can build and retain more wealth with an SDIRA:

- Diversify investments: An SDIRA gives you both conventional and alternative investment opportunities. These include business ownership, real estate, precious metals, cryptocurrencies, stocks, bonds and mutual funds. Each asset class offers distinct tax advantages, and spreading your wealth across diverse assets could help improve your returns and limit your risks. While owning and operating a business will likely incur UBIT, the potential upside outweighs the cost of taxes.

- Time withdrawals and contributions: Waiting until you turn 59 ½ before withdrawing from your SDIRA and keeping up with your required minimum distributions (RMDs) afterward can help you avoid penalties. Maximizing your tax-deductible contributions without exceeding the IRS contribution limits lets you save more and can reduce your taxable income depending on the type of SDIRA you have.

- Leverage exemptions: If you own an LLC through your SDIRA, you can maximize your total income relative to your UBTI by having the LLC generate UBIT-exempt income through royalties, interest and dividends. For example, your LLC could register new intellectual property and license it to other companies to earn UBIT-exempt royalties.

- Consider a blocker or offshore corporation: If your IRS owns a domestic or offshore C-corporation and operates an LLC, it may be possible to avoid UBIT and pay lower corporate income tax instead by having the LLC pay the corporation. This is a more complex strategy, so consult a financial or tax professional to conduct due diligence if you’re considering it.

- Align your SDIRA with your goals: You can consider four types of SDIRAs — traditional SDIRAs, Roth SDIRAs, Simplified Employee Pension (SEP) SDIRAs and Savings Incentive Match Plans for Employees (SIMPLE) SDIRAs. The right type of SDIRA and the right assets to include in it depend on factors like your age and projected tax bracket at retirement compared to now. A professional experienced with SDIRAs can help you make informed decisions for your long-term financial security.

- Partner with professionals: While SDIRAs provide flexible investment opportunities and multiple potential tax advantages, they are subject to strict regulations. An expert in self-directed IRAs can simplify the process of setting up your SDIRA and advise you to ensure your investments comply with IRS retirement account rules while minimizing your tax burden.

Take Control of Your Retirement Plan With Accuplan

A self-directed IRA lets you prepare for your retirement your way. However, navigating UBIT and other tax implications of your SDIRA investment decisions requires a solid grasp of IRS regulations, tax advantages and the investment strategies available. For peace of mind about your retirement plan, partner with the seasoned professionals at Accuplan.

Accuplan’s SDIRA specialists have been helping people start and manage SDIRAs for years, and most of our employees are approaching two decades in the industry. When you work with Accuplan, you get to invest for retirement how you want, while our team helps you find the simplest and most tax-efficient ways to do so. Whatever your retirement goals, Accuplan has the expertise to help you achieve them.

Contact us today to discuss your retirement plans with an SDIRA expert.

Our information shouldn’t be relied upon for investment advice but simply for information and educational purposes only. It is not intended to provide, nor should it be relied upon for accounting, legal, tax or investment advice.

Frequently Asked Questions

Just as with regular taxes, April 15th is the set IRS-mandated Tax Day (unless otherwise stated by the IRS).

UBIT is not illegal or considered a prohibited transaction by the IRS within retirement accounts.

IRA funds aren’t entirely tax-exempt when an “unrelated” aspect of UBIT or UDFI comes into play. When you invest in Limited Partnerships or LLCs that generate income unrelated to the IRA, UBIT and UDFI are triggered and considered taxable in your IRA.