Self-directed individual retirement accounts (IRAs) are excellent accounts that allow you to invest your retirement funds into alternative assets like cryptocurrency, real estate and tax liens. Even with all its amazing benefits, there are certain rules and regulations to follow that may help you avoid disqualifying your self-directed IRA and incurring penalty fees.

All it takes is a better understanding of your responsibilities and how to make informed decisions and investment choices. From self-directed IRA tax rules to avoiding prohibited investments, this guide explores the most important IRA guidelines and the consequences of becoming disqualified.

7 Most Important Self-Directed IRA Rules

Here are some self-directed IRA guidelines that may help you avoid legal and tax consequences.

1. Perform Due Diligence

It’s best to perform due diligence yourself before placing an alternative investment. Accredited investors can participate in investments not registered with the Securities and Exchange Commission (SEC), but these investments may have extra risk. Do the necessary research to ensure this is safe for you.

It’s also good to choose a provider experienced with the investment you want and legal and tax professionals to ensure your investment plan is suitable for your financial situation. Some tips for proper due diligence include:

- Inspect tangible assets

- Vet potential business partners

- Understand the associated taxes

- Learn the rules specific to your type of asset

- Thoroughly research the prospective investment

- Seek advice from successful and reputable investors

2. Avoid Prohibited Transactions

A prohibited transaction is any improper use or transfer of money out of the IRA by a disqualified person, such as the account holder, a beneficiary or a fiduciary. When Congress created the Employment Retirement Income Security Act in 1974 to encourage American employees to save for retirement, they also enforced prohibited transaction rules to prevent them from taking advantage of their retirement accounts too early.

For example, someone might want to lend themselves money or buy property for personal use. This would count as a prohibited transaction. Similarly, the IRA is prohibited from transacting directly with immediate family members or other close entities. Instead, the IRA may only transact with third parties, whether it involves leasing or the purchase of real estate. If the IRA holder were to make a prohibited transaction, the entire account would be distributed, leaving them liable to pay the relevant taxes and penalties associated with this violation.

3. Refrain From Initiating Indirect Benefits

Similarly to making transactions for your own benefit, self-directed IRA guidelines prohibit account holders from initiating indirect benefits. This includes certain actions or transactions that benefit the account owner before retirement. Many factors might classify as an indirect benefit. Here are three examples:

- Paying out of pocket: Personally paying for expenses your IRA should cover is an indirect benefit and may disqualify your account.

- Living in an IRA-owned property: Living in an IRA-owned property will disqualify your self-directed IRA.

- Loaning IRA funds: Another prohibited action involves loaning your IRA funds to an unrelated party and having them pay it back.

4. Understand Self-Directed IRA Tax Rules

It’s important to be aware of any taxes you might owe on your IRA funds, whether now or in the future. Some self-directed IRA tax filing requirements include:

- Unrelated business income tax (UBIT): When an IRA gains “active income” on real estate developments, active businesses or short-term flips, it becomes subject to UBIT.

- Traditional self-directed IRA taxes: These types of IRA contributions are usually tax-deductible and tax-deferred, meaning you only pay taxes when you make qualified withdrawals in retirement.

- Roth self-directed IRA taxes: Roth IRA funds are taxed before contribution into the IRA, so the money’s growth and distributions are tax-free.

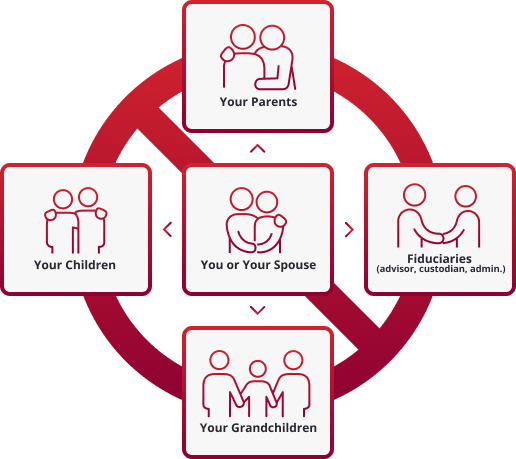

5. Avoid IRA Transactions With Disqualified Persons

With a self-directed IRA, certain people and entities are prohibited from doing business within the account, known as disqualified persons. These may include:

- The account owner

- The account holder’s spouse

- Beneficiaries of the IRA

- Lineal descendants, such as your children and their spouses and your grandchildren and their spouses

- Lineal ascendants, such as your grandparents and great-grandparents

- Entities of which you own 50% or more

It’s worth noting that an entity can be a limited liability company (LLC), business partner, corporation, trust or estate that you own 50% or more of. Transacting money in the name of these entities or through them violates IRS rules. Additionally, you cannot conduct transactions with anyone providing services to the IRA assets.

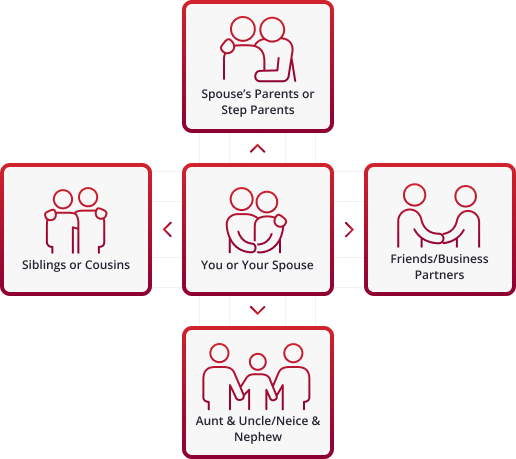

Other than third parties who may conduct transactions within the account, there are other related people whom the IRS allows your IRA to do business with, including:

- Your siblings

- Your spouse’s parents

- Your nieces or nephews

- Friends

- Any stepparents and step-grandparents

- Aunts, uncles or cousins

6. Submit Fair Market Valuation (FMV)

The FMV is an asset’s value or annual selling price. If you have a self-directed IRA, you must submit a report to the IRS annually to inform them of any changes in the value of your assets.

7. Self-Directed IRA Prohibited Investments

While self-directed IRAs generally give you more freedom and flexibility than a conventional IRA would provide, there are allowed and disallowed investments for self-directed IRAs. While the law has yet to give a specific list of allowed investments, the IRS restricts some investments, including:

- Collectibles: Collectibles include items like certain metals, coins, gems, stamps, artwork, rugs, alcoholic beverages and antiques.

- S-corporations: When a trust qualifies as an IRA, it becomes ineligible to be the shareholder of an S-corporation.

- Life insurance: The law prohibits IRAs from investing in life insurance.

What Happens if an IRA Is Disqualified?

If you violate any of the above IRA rules, your self-directed IRA will become disqualified. The IRS may issue you a penalty fee of 15% of the prohibited transaction amount for you to pay within a certain period. If you miss the deadline, the IRS will likely charge you additional tax of 100% of the transaction amount.

Open a Self-Directed IRA With Accuplan

Whether you’re well-versed in how IRAs work or just started learning about them, it’s always best to connect with a tax or legal professional who can advise you. Our knowledgeable self-directed experts at Accuplan Benefits Services are ready to assist with any questions about staying compliant with IRA rules and regulations. Otherwise, we have a range of resources to help you better understand self-directed IRAs.

As professionals with vast industry knowledge and many years in the business, we welcome you to schedule a call with us or open a self-directed IRA with Accuplan today.

Have questions about IRA rules and regulations?

Schedule a call with a self-directed expert here

Additional Resources

Our information shouldn’t be relied upon for investment advice but simply for information and educational purposes only. It is not intended to provide, nor should it be relied upon for accounting, legal, tax or investment advice.